Freescale vs. TI: Base station SoC battle

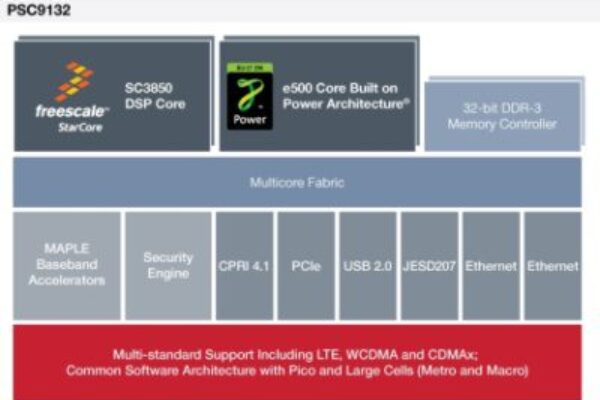

Freescale is rolling out a scalable, multimode wireless base station processor family, dubbed QorIQ Qonverge. The new family of products, designed to scale from small cells (Femto and Pico) to large cells (Metro and Macro), share a common architecture consisting of Freescale’s proven multi-core communication processor, multi-core DSPs and baseband accelerators.

Freescale’s new baseband SoC is also playing a critical role in lightRadio technology, recently announced by Alcatel-Lucent. LightRadio technology, which Alcatel-Lucent is working on with Hewlett Packard and Freescale, is designed to help create mobile phone wireless base stations for carriers that are said to be "barely bigger than a golf ball.” Lisa Su, senior vice president and general manager of at Freescale’s networking and multimedia group, said, “Our new baseband SoC is in it.”

Texas Instruments, on the other hand, has developed a new multimode wireless base station chip, called TMS320TCI668, delivering “double the LTE performance of any existing 40nm SoC,” according to the company. TI has added hardware accelerators to the company’s recently announced base station SoC, called TCI6616. Both TCI6618 and TCI6616 use TSM320C66x – TI’s new DSP featuring floating point and fixed point math in every core.

Facing exponentially increasing data traffic, network operators have been scrambling to find new solutions to their networks.

Freescale’s Su bluntly put: “Most operators can’t keep up with data traffic today.” Operators want network solutions that are “multi-mode” and “future proof,” she explained.

While the transition to LTE could help, LTEs are still in early stage, said Su, despite a number of trials. If operators are still building out a 3G network, they want that equipment “to be 4G capable,” she said.

In explaining the wireless network architecture’s current state of flux, she added: “Femto cells, deemed an ‘interesting solution’ six months ago, are now a part of the solution many operators are looking at.” Network operators want network architecture “optimized for cost, performance and capacity,” she added.

Many in the industry agree that there is no one-size-fits-all answer to the wireless network architecture of tomorrow. “Everyone is designing their own vision of network architecture right now,” observed Brian Glinsman, general manager of TI’s communications infrastructure business. “Solutions proposed by equipment vendors are colored by their top five customers,” he added. This trend, in turn, influences semiconductor suppliers’ base station SoCs.

“Any operator who says they know what client devices will demand in flavors of 802.11, WiMax, LTE, various flavors of 4G…is lying, overly optimistic, or both!” noted Rick Doherty, co-founder and director, at The Envisioneering Group. “So the only sane survival method is build cell systems with agile software radio support until 4G ‘stratifies’ into clear winners… again, driven by the consumer, business and institutional device mix and demand.”

TI’s strategy is squarely focused on “spectral efficiency.” The new hardware acceleration integrated in the TCI6618 is responsible for handling the high numbers of bits flowing through base stations, while freeing the programmable DSP cores’ processing power to execute customer differentiation chores like scheduling and multiple-input and multiple-output (MIMO) antenna processing. TI claims the new TCI6618 enables gains “up to 40 percent spectral efficiency.”

By making TCI6618 pin and software compatible with TCI6616, TI offers customers flexibility in designing multimode base stations supporting all 2G, 3G and 4G standards, according to the company.

TI’s TCI6618 base-station SoC does not come with a RISC processor — necessary for network processing. The company won’t be detailing such a base station SoC complete with a cluster of ARM cores until mid-2011. As an interim step, in collaboration with Axcom Technology, TI is offering a new 3G/4G small cell base station platform in the second quarter of 2011. The platform consists of TCI6616 SoC for PHY and Layer 2 processing; C6A8167 Integra DSP+ARM processor for Layer 3 processing; GC5330 transmit/receive processor for digital radio front-end processing; and NaviLink 6.0 solution GPS for clock synchronization. “We are offering such a platform now so that developers can start writing code,” explained Glinsman.

In contrast, Freescale’s plan is to start offering a family of base station processors integrated with their proven network processor.

Freescale’s QorIQ Qonverge processors combine on a single chip: multiple Power Architecture cores; StarCore DSPs with MAPLE packet processing acceleration engines; and interconnect fabric. Noting that there will always be waste in a system using discrete components, Su pointed out the efficiency of the QorIQ Qonverge processor, in particular, comes from its multi-core fabric. “We spent a lot of time developing it.”

“The key strength of Freescale is that it has both well-established CPU and DSP technology,” noted Joseph Byrne is a senior analyst at The Linley Group. “Nobody else is in the same position.”

According to Byrne, “Freescale’s embedded-processor business has been stronger than its DSP business, which creates a particularly good opportunity for the company.”

He explained, “Freescale is well-placed to lure OEMs that had been using TI DSPs with Freescale embedded processors, eliminating TI from these designs.” TI, of course, will try to do the reverse but [the company] is not a well-established supplier of embedded processors, he added.

In all fairness, the timing for the availability of complete base station SoCs – both from Freescale and TI — may not differ much in the end. Both are aiming at the second half of 2011. But analysts believe Freescale may have an edge. “We think Freescale’s exisitng and new customers will get to the market faster because Freescale offers more tools and endorsed, trusted third party solutions (like performance monitoring) than TI,” said Doherty. “Time to market, flexibility to change designs as market demands (more so on enterprise cell than femto cell) is criucial.”

Freescale is seeing fundamental changes in base station design and deployment. Freescale’s Su described the expected proliferation of tiny base stations enabled by Alcatel-Lucent’s lightRadio technology as akin to cloud-computing. “Instead of racks of servers, we now see a network of desktop connected to cloud,” she said. Similarly, by combining Alcatel-Lucent’s antenna and RF communications with Freescale’s digital baseband unit, “you will soon see a network of small base stations that are the size of a Rubik’s cube,” enabling networks.

The Linley Group’s Byrne agreed. “The big-picture is that mobile broadband requires a dense network of base stations, but carrier’s capital expenditure is limited. Thus, some kind of solution that provides density economically is required.” He said that lightRadio looks like the kind of architecture that can do the trick.

This article first appeared on the EETimes website: www.eetimes.com

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News