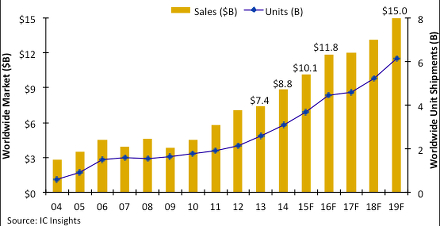

The strong annual growth rates of 18.9, 14.8 and 16.8 percent in 2014, 2015 and 2016, respectively, are due to increasing application diversity after a climb in the first half of the decade on the back of smartphone proliferation, the market analysis company said. Now similar resolutions and lower-resolution sensors are moving into automotive applications, machine vision, surveillance and sensors for Internet of Things, the firm argued.

IC Insights gave no reason for the expected pause in sales growth in 2017 although this may represent an expected market reaction to a potential oversupply of sensors.

In 2015 the CMOS image sensor market will climb 14.8 percent to reach a value of $10.1 billion, IC Insights reckons. CMOS image sensor unit shipments are now projected to grow 19 percent in 2015 to reach 3.7 billion units after rising 20 percent in 2014 and 2013.

Global CMOS image sensor market by market value and unit shipments. Source IC Insights.

In 2014, about 70 percent of CMOS image sensor sales – about $6.2 billion – were for embedded cameras in mobile phones, but that percentage is expected to fall to 49 percent in 2019 or about $7.3 billion, which represents a compound annual growth rate (CAGR) of just 3.4 percent. In comparison, total CMOS image sensor sales are projected to grow by a CAGR of 11.1 percent in the five-year forecast period to reach $15.0 billion in 2019.

Next: growth rates by application

During the same period sales of CMOS image sensors for automotive safety systems will climb at a CAGR of 57.4 percent to $2.1 billion in 2019 by which time they will represent 14 percent of the market’s total dollar volume that year compared to just 3 percent in 2014.

CMOS image sensor sales for security systems and surveillance applications are expected to grow by a CAGR of 38.4 percent in the five-year forecast period to $899 million in 2019, which will represent 6 percent of the market’s total sales that year versus 2 percent in 2014. Medical and scientific imaging applications of CMOS image sensors are expected to enjoy a CAGR of 36.0 percent to $824 million in 2019 or about 6 percent of the total market compared to about 2 percent in 2014.

Toys and video game applications are expected to increase sales of CMOS image sensors by a CAGR of 32.7 percent to $255 million by 2019, which will represent 2 percent of the market’s total revenue compared to 1 percent in 2014.

Next: Vendor ranking for 2014

Sony, the leading CMOS image sensor supplier, is now aiming at confirming a leading position in the automotive image sensor market just as it has done in the mobile phone market.

Sony’s CMOS image sensor sales grew 31 percent in 2014 to about $2.8 billion, which represented a 32 percent share of the market’s total revenues, accordning to IC Insights. IC Insights ranks OmniVision second in CMOS image sensor sales with a value of $1.4 billion in 2014 followed by Samsung ($1.2 billion), Sharp ($720 million), SK Hynix ($488 million), and China’s GalaxyCore ($360 million).

Related links and articles:

News articles:

Omnivision loses ground in CMOS image sensor ranking

Top ten CMOS image sensor vendors ranked

On Semi to buy Aptina for $400 million

CCD image sensors are dead, says Yole

CMOS image sensor market on 10.6% CAGR

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News