Power Trends: Microsemi sees integration from device to module drive innovation

“A lot of our roadmap and decisions and investments are based on initiatives of lead customers in Europe,” said Siobhan Dolan Clancy, Vice President and Gneral Manager of the discrete products group at Microsemi based in Ireland. “My position is evidence of our strategy. When I took over this group in April we integrated all of our power solutions in one entity – we have power and RF within the discretes group and integrate from the device level at the fab through our packaging expertise from devices to modules and then integrated with the power systems team, all in the same organisation.”

“We feel that’s really important for the markets that we serve – customers are looking at the total cost of ownership not just the device costs. It’s not just individual devices or modules, they are looking for tradeoffs at a system level and Microsemi is uniquely positioned to provide this.”

The discrete products group makes up around a third of the company’s $1.2bn turnover in 2105.

“As a company, the main market segments we target are industrial with niche areas such as high frequency and high voltage applications, and we are going after those markets with silicon and silicon carbide technologies. These are things like welding, renewable energy, and induction heating, all the areas where the switched mode power supply and inverters are at the heart of the design so that our technology and packaging in modules can provide the greatest differentiation.”

“We are very selective,” she said. “The growth areas are in higher frequency and higher voltage and we have a comfortable market share in the more mature markets, so in some of these we are seeing 5 – 8% growth.”

Technology challenges

There is still a huge challenge to provide efficient power conversion in a smaller footprint with higher reliability, she says, as well as cost. “We are very aware of the cost challenges,” she said. “as well as doing the device design and package design we have to focus on the manufacturing strategy internally and with external partners. You can bring a wonderful technology to market but if you can’t bring it to market at the right price you have no business.”

“Medical is a major play for us today and we are targeting SiC for smaller equipment with higher switching frequencies for applications such as MRI imaging. Then there’s automotive designs in the electric vehicle and charger – both inside and outside the car – we already have a strong involvement in this areas, reducing size. Reliability is also a big issue for the automotive industry and we have a huge heritage in reliability and total cost of ownership and shared responsibility at the product level, and the automotive market is ideal for SiC MOSFETs both as discretes and modules.”

“The other area of focus is aerospace – this is typically much lower volume and more reluctant to adopt new technology but it’s also becoming more cost conscious. They are looking seriously at wide band gap semiconductors and this is an area when you look at the total solutions. We are taking the SiC MOSFETs and diodes and integrating those into power modules that are ruggedized and designed specifically for reliability and longer lifetimes such as flight control systems in aircraft and integrating more intelligence and analogue mixed signal ICs for telemetry from the motor control and FPGAs – that works right across the group.”

This is driving expansion in Europe. “We are building a systems team as a centre of excellence and manufacturing capability here in Ennis, Ireland,” she said. “We have a mission-specific reliability programme that runs at device, module and system level to demonstrate the MTBF of the technology and packaging over two years – it’s a major demand from the market right up to the airframe level,” she said.

The new demand for power systems has also driven changes in the company structure. “In the past it was individual product organisations – now we are organising as a solutions company and the CTO’s office is taking a much stronger role,” she said. “So now a systems engineer in the CTO’s office reports to me feeding the needs from the airframe level – how does this fit into the overall needs of the power systems, the in-service MTBF at an aircraft level, and how does that feed down to the IPS and power sub-systems. All of this feeds back into the device roadmap for the SiC chip that’s suitable for that application.”

Does this mean the company is looking to have more vertical integration? “We are trying to enable our device level development and packaging through our system level expertise, not become a systems level company,” she said. “From the product and R&D perspective we go from the vertical to the horizontal, but that also opens up the horizontal opportunity by using the knowledge and expertise in any one of these markets across other market segments – for example the type of qualifications for automotive we are using for higher reliability applications such as aerospace. That’s opening up new opportunities in adjacent markets.”

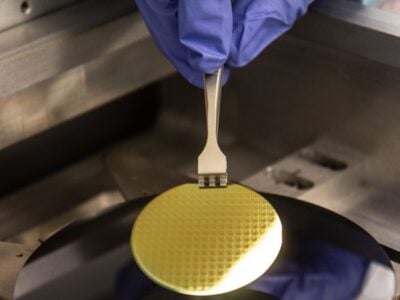

The consolidation in the industry is both an opportunity and a threat, she says. “All the applications we are going after are hugely cost sensitive. We have the advantage of our own wafer fabs, testing and screening but as the market grows, the future is moving to 6in, so we will work with both external foundry partners and internally. We will continue and evolve our external partnerships from foundries to packaging to test and even university partnerships in industries such as aerospace. And we have to be seen to evolve and move with the market and help the market to adopt the new technologies such as wide band gap and new packaging. So we have to make sure we are working to help customers adopt the new technology and the timing of that is always a threat. The industry needs wide band gap and we will continue to work on GaN and GaAs roadmap – there will be ups and downs along the way.”

The focus for GaN is for space power looking at packaging and radiation characteristics largely through foundry partners. “We are looking at foundry partners for GaN and packaging and will ramp our investment depending on the market development,” she said. “We have a lot of technology on the RF side with GaAs – it’s used in high volume for RF diodes but with GaN we see more evolution.”

“I think for us it’s the momentum around electrification that’s driving the market,” she said. “That goes across industries from automotive to aerospace. There’s a huge environmental awareness that driving huge advances in power and that for us is hugely exciting. The innovation that’s required is removing the conservativeness in some of the designs that we have seen previously. It excites us in the challenges and in double digit growth opportunities, both from the engineering and technology but also because we are well positioned. I think it brings great growth opportunities for us as a company.”

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News