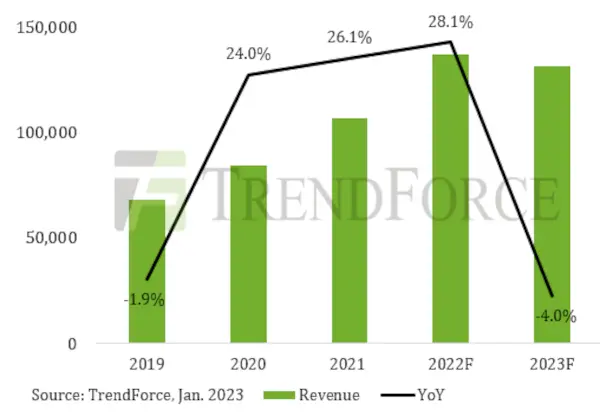

Foundry market set to fall 4% in 2023

The market for foundry semiconductors will fall by around 4 percent in 2023, according to TrendForce. This would be a more severe annual decline than that recorded in 2019, the market researcher said.

TrendForce estimates that in 2023 demand will continue to slide for all types of both mature and advanced nodes.

Global foundry semiconductor market 2019 to 2023 ($millions). Source: TrendForce

At present it can be seen foundries are expected to be stuck with low capacity utilization for the 1H23 because IC design houses have cut wafer orders for 1Q23 and will likely scale orders down even further in 2Q23. Some nodes could experience a steeper demand drop in 2Q23 as there are still no signs of a significant rebound in wafer orders, TrendForce said.

Orders could pick up for some components in the 2H23 but the global economy remains uncertain. Geopoliticial uncertainty is also having an impact as IC design houses are preparing to reduce chip production in China. The re-allocation of foundry orders will be increasingly noticeable in 2H23 and obvious in 2024, TrendForce said.

This means that the recovery in foundry manufacturing capacity utilization will likely vary with some picking up orders more quickly and others continue to languish. This order re-allocation is set to be more significant in the 200mm wafer segment.

200mm versus 300mm

On 300mm wafer TSMC is expected to experience low capacity utilization through 1H23. There is scope for order pick up on 7nm in 2H23 with 5nm utilization coming back to an optimal level towards the end of 2023, TrendForce said.

In contrast Samsung is likely to see utilization rates for sub-8nm nodes remaining low through-out 2023. This is chiefly because its main clients Qualcomm and Nvidia have opted to reallocate orders to other foundries, TrendForce said.

In the medium- to long-term the foundry industry will be impacted by more than 20 wafer fabs being built as countries provide subsidies. As a result the foundry market will become more fragmented with diversification of production capacity across different regions.

According to TrendForce’s count Taiwan will have five of these new fabs, the US will have five, China will have six, Europe will have four, and another four will be located among South Korea, Japan, and Singapore.

Related links and articles:

News articles:

Taiwan foundry in talks over Indian wafer fab

YMTC could be out of 3D-NAND by 2024, says TrendForce

China’s Hua Hong foundry IPO set to raise $2.5 billion

Tower foundry’s growth tapers down in 3Q22

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News