Twelve months after joining from Silicon Labs, new president and CEO Necip Sayiner has significantly changed the company focus.

"What we found when we came in was capable people and some great fundamental IP but they were trying to do too many things – they didn’t have the resources to drive leadership, develop new products and translate that into market share," said Mark Downing, senior vice president of strategy at Intersil. "So we are focusing on our core strengths around power management."

Power is 60% of the business today and that will rise to 80% over the next three years, says Downing. Most of the analog product lines will be discontinued, leaving the high reliability, space and automotive products.

"As part of that change we are building up the design centers, looking to build up the ones we’ve got, adding people in the UK, New Jersey and Austin, Texas," he said. The UK design center in Harlow employs 35 designers working on screen power control which is part of the new strategy.

"I think the problem is that the analog products may be reasonable businesses but they all needed investment and what we found was the businesses were struggling to get real traction. The company needed to focus back on its core competence so those businesses were deemphasized or closed down completely," said Downing.

"With the focus on power management we can get growth resuming next year, primarily based on investment decision we made last year. Precision analog will still be an investment area, but modest as there are areas in that that are essentially power, in automotive and space. It’s like everything we will do is power – today its 60% and that will grow to 80%. On the speciality analog side, there’s optical sensors and drivers, previously driven by Blu Ray, now by gaming applications such as Microsoft Kinect and in the future could be heads up displays in automotive. But this is a cash cow that we will use to fund the other three businesses."

Instead the focus is on $6bn market for power management in mobile handsets, where competitors such as Fairchild Semiconductor, Dialog Semiconductor and Maxim have already made strategic moves, and on power control in infrastructure designs.

“If you think about the smartphone today the functionality and the compute power will continue to advance and as it does the current levels are going up,” he said. “Today there are multiphase converters that will be used more broadly and the challenges are only going to get bigger. This is the strong heritage that Intersil has, so we will apply that technology and learning into the mobile space. If you compare that to Fairchild they don’t have expertise in that area, while Dialog and Maxim are learning this.”

"In mobile there’s a couple of interesting things that play to our strengths," he said. "We have interesting IP in the buck boost converters that are world beating in the efficiency they provide as well as the transient performance. It’s an IP that we acknowledge other people will emulate and will get to the same level of performance but it generates nice business right now."

This is being driven by processors with multiple cores using currents peaking at 8 to 12A peak, he says. "They will move up to using three phase because they have to keep the profile of the inductors very small so they can only deal with small discrete current levels. That’s the theory but we think the market is moving in our direction in talking to our big customers," he said. "We will be a new player in that market but we play more broadly in the notebook and tablet markets where they use multiphase for the higher currents."

The other side of the business will be digital power control for infrastructure, from data centers to telecoms racks.

"On the infrastructure side the play we have there is really around digital power control and integrating it with the power and the MOSFETs," he said. "The advantages of that are ease of design and highest possible power density so you can get that power into the smaller footprint and the flexibility and programmability of output and sequencing, storing firmware code for customization, for example."

"There’s a lot of benefit from digital control but what’s been an inhibitor is the price premium,” he said. "As the geometries have scaled down you get more benefit from feature size reduction and that has helped close the gap. We are now starting to see a tipping point with server customers using digital control and that’s moving into infrastructure and telecoms designs with customers using the PMbus to manage the converters at a system level. Many of the systems are dealing with 30,40,50 voltage rails and having a powerful GUI provides an easy to use solution in what is a complex system," he said.

That naturally leads into envelope tracking, using digital power control of RF amplifiers to increase efficiency. "That’s an area that we are investigating right now," said Downing. "We don’t have products in development right now but if you are going to pull that off you need some breakthrough technology on the power management side."

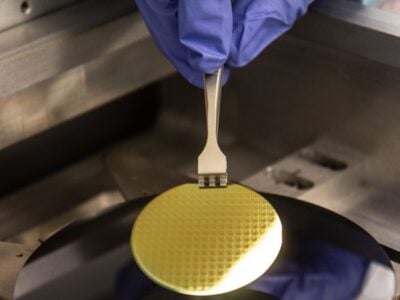

The company will keep the analog fab at its former headquarters in Florida, upgrading the 0.35 micron line to 8in wafers for space customers but the bulk of the power management products are using more advanced processes with foundries.

www.intersil.com

Related stories:

Intersil seeks to become $1 billion player

60-A digital POL dc-dc module sets performance benchmarks

Mark Levinson teams up with Intersil D2Audio to develop custom-tuned audio amplifiers

Voice and data switches eliminate clicks and pops

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News