Power Trends: Customization and consolidation drive the market – Excelsys Technologies

Excelsys in its current form has been around since 2000, originally a division of Deltron in Dublin that became Delaire Ltd in the early 1990s as a management buyout. After external investment and a change in direction to develop standard products to reduce the reliance on a small number of customers, it became Excelsys, growing its business over 20 fold by the end of last year.

“As a company our focus always been about power supplies for mission critical, high end systems,” said Flynn. “We are not developing mobile phone chargers in the high volume business. Instead we focus on the high reliability, high efficiency AC-DC business for medical, industrial and hi-rel segments with a lot of mixed technology.”

There are very clear parallels with the dotcom boom and bust in 2000 and the consolidation in the market today. The consolidation in the power industry over the last few years have been about revenue growth, not necessarily strategic fit, he says. “It’s not surprising with 20/20 hindsight. What you found over the years that the companies find it difficult to integrate the businesses they bought. Often the focus may be in communications and computing, so that’s where R&D was concentrated. However this focus also let the other parts of the business dwindle as these weren’t the areas that the stock market cared about,” he said.

“It’s no surprise to me now when you saw the revenue drop, as when the downturn came the computing and storage businesses were hit the hardest and there weren’t the other areas to fill the hole any more. That’s where companies like Excelsys were finding our niche.”

“I suspect there’s more consolidation to come down the line,” he said. “You can only be experts in certain things and companies will be buying up the expert companies in certain niches.”

There is also an emerging market aspect to the consolidation. “There will also be consolidation for companies looking to sell outside of China looking to sell to Europe and the US. There aren’t many Chinese power supply brands that stand out. You’ve seen that with Huawei and ZTE moving into Europe so it’s only a matter of time for a Chinese power company to come to Europe and they may well that through a US or European company, so I think there will be more consolidation over the coming years.”

The takeup of digital power is also slower than expected in these niche markets, he says. “I recall the advent of digital power back in late 1990’s and almost 20 years later the level of adoption of digital power is still relatively low. Is it coming? Absolutely, but if you believe the industry analysts from 15 years ago, we should all be immersed in digital. There’s an increasing amount of digital control being used in power. We put PMbus communications on our supplies, not because customers are using it right now, but they will in the next four to five years. Yes, in the communications industry they use it all the time but outside the mainstream computing and telecoms industry it is a lot less popular. It will come, but it’s a slower move.”

The takeup of digital power is also slower than expected in these niche markets, he says. “I recall the advent of digital power back in late 1990’s and almost 20 years later the level of adoption of digital power is still relatively low. Is it coming? Absolutely, but if you believe the industry analysts from 15 years ago, we should all be immersed in digital. There’s an increasing amount of digital control being used in power. We put PMbus communications on our supplies, not because customers are using it right now, but they will in the next four to five years. Yes, in the communications industry they use it all the time but outside the mainstream computing and telecoms industry it is a lot less popular. It will come, but it’s a slower move.”

That move to digital technology is inevitable. “I do believe digital control within the supply is certainly one of the key drivers to reduce component count, size and improve the efficiencies – it’s certainly a key driver for any future development. The need on the customer side to adopt it is not as strong,” he said.

Instead it is reliability that really matters to customers. “In our niche proven reliability is becoming more important so longer warranty parts. That’s certainly a driver. We are in challenging environmental times so the aim is to reduce energy consumption or improve the energy conversion, and efficiency and reliability run hand in hand – if it’s more efficient and runs cooler it will be more reliable and that’s where digital control comes into play. You also want to remove moving parts such as fans to improve the reliability so we are seeing more requests for fanless with the multiple outputs that medical and industrial customers are looking for.”

Reliability is becoming a key driver for people now as servicing costs are very important, he says. “That’s where there will be innovations, with more use of the Internet of Things (IoT) to schedule preventative maintenance – monitoring temperature sensors and checking out problems in the early stages. If you take that to another level and put that in the power supply, monitoring changes in the current drawn by a power supply or output fluctuations for example, can direct service technicians to identify a system change before it becomes a problem.”

This is opening up new opportunities for innovation and new business models for power supply makers, monitoring and managing data about a supply’s performance.

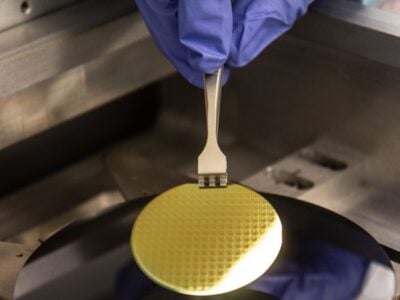

“I could see that possibly being a business model with the increased communication. Whether people will pay for it is another matter,” he said. “I can see it working for certain segments. If it’s in a wafer fab then every hour of downtime is a couple of million dollars and I think the next evolutionary step is to get key communications with the key components within the system and the power supply is probably the first port of call.”

One of the challenges in the industry is that development cycles are getting shorter and engineers have to get the product up and running faster without having to wait for a custom power supply, he says. This has led to the configurator web-based software.

“We took the approach that our product is made from off the shelf building blocks that you combine and adjust the voltage with an onboard potentiometer. When you put in the different output voltages that are different for everyone, we take that purely on the output stage and take all the outputs and work out the front end that will support that. The Excelsys online configurator will take all the volts and amps requirements and determine the best solution – because there’s no soldering required our stocking distributors can provide the piece to a customer in 24 or 48 hours.

“We took the approach that our product is made from off the shelf building blocks that you combine and adjust the voltage with an onboard potentiometer. When you put in the different output voltages that are different for everyone, we take that purely on the output stage and take all the outputs and work out the front end that will support that. The Excelsys online configurator will take all the volts and amps requirements and determine the best solution – because there’s no soldering required our stocking distributors can provide the piece to a customer in 24 or 48 hours.

“So if, or when, they need to make a change they don’t have to wait months for a different custom supply. You have taken a whole chunk of time and reduced headaches of the supply chain group and the development group as the engineer in working with a commercial power supply rather than a bench supply,” he said.

“For sure, it’s not absolutely optimised for space etc a full custom power supply would be but for the vast majority of customers in the low to medium volume, full custom is simply not a viable economic option. The time to market for a custom supply is the biggest factor – I think that’s a challenge for everyone and nobody is immune from that. Every month or two months they save in R&D is a huge amount of money.”

“The power industry is very fragmented – there’s no ‘one size fits all’ and the PC industry has essentially died a death so they will think it’s a terrible market, but someone in the LED lighting market will see the numbers going up. We are in the industrial and medical markets and even those are fragmented and will have different growth numbers. We would say that customisation is not necessarily full custom and you are getting what you want that’s unique to you. This is our niche – this is what we do, so we have a focus in this area and be experts.”

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News