SEMI: 300mm fab equipment spending worldwide to hit $374B by 2028

Cette publication existe aussi en Français

Cette publication existe aussi en Français

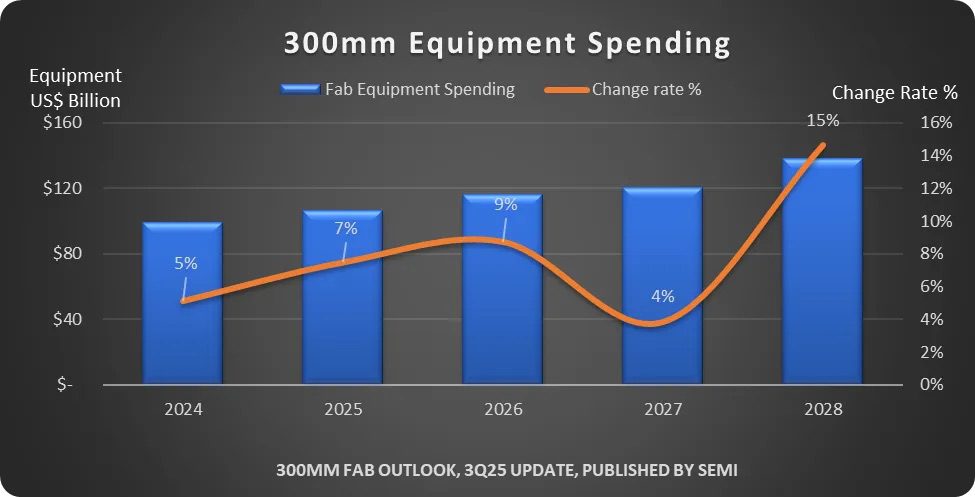

Global 300mm fab equipment spending is projected to hit $374 billion between 2026 and 2028, according to SEMI’s latest 300mm Fab Outlook report released at SEMICON West. The surge reflects regional fab expansion, booming AI chip demand, and a worldwide drive toward semiconductor self-sufficiency.

For eeNews Europe readers, these forecasts highlight where chip manufacturing capacity — and corresponding equipment opportunities — will expand next, impacting suppliers, foundries, and materials providers across Europe’s growing semiconductor ecosystem.

AI and regionalization drive fab expansion

According to SEMI, 2025 will mark the first time global 300mm fab equipment spending surpasses $100 billion, rising 7% to $107 billion. The industry is expected to continue its climb with $116 billion in 2026, $120 billion in 2027, and $138 billion in 2028, reflecting sustained momentum across logic, memory, and power segments.

“The semiconductor industry is entering a pivotal era of transformation, driven by unprecedented demand for AI-enabled technologies and a renewed focus on regional self-sufficiency,” said Ajit Manocha, President and CEO of SEMI. “Strategic global investments and collaboration are driving robust, advanced supply chains and faster deployment of next-generation semiconductor manufacturing technologies. The global expansion of 300mm fabs will enable progress in data centers, edge devices, and the digital economy.”

The Logic & Micro segment is expected to lead the charge with $175 billion in investments through 2028, powered by foundry build-outs below 2nm and advanced technologies such as gate-all-around (GAA) and backside power delivery. SEMI forecasts that 1.4nm process technology will enter volume production by 2028–2029, further accelerating AI and edge-device performance gains.

Meanwhile, the Memory segment is set for a rebound, totaling $136 billion in spending — including $79 billion for DRAM and $56 billion for 3D NAND. AI workloads requiring high-bandwidth and low-latency memory continue to push demand for HBM and NAND storage, stimulating long-term investment across the supply chain. Analog and power-related segments will contribute an additional $41 billion and $27 billion, respectively.

China leads, Europe ramps up

Regionally, China will remain the top spender with $94 billion invested between 2026 and 2028, followed by Korea ($86B) and Taiwan ($75B). The Americas are forecast to invest $60 billion, reflecting ongoing efforts to localize chip production and meet growing AI-related demand.

Closer to home, Europe and the Middle East are expected to invest $14 billion, while Japan and Southeast Asia will see $32 billion and $12 billion, respectively. SEMI notes that policy incentives are boosting fab construction and equipment spending across all three regions, with investments projected to climb more than 60% by 2028 compared to 2024.

The new SEMI report, part of the 300mm Fab Forecast database, tracks 391 fabs and lines worldwide — including nine new facilities added since January 2025.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News