US and EU de-escalate trade tensions, but questions remain

The July 27, 2025, announcement of a new trade deal between the United States and European Union marks a shift in economic policy. And, unsurprisingly, it kicked off a new round of debates among politicians, pundits, and business leaders. What’s clear, though, is that after months of threats and heated trade-focused disputes, the deal represents a positive move to stabilize relations between the world’s two largest economies.

We are waiting on more details. Still, we know the initial framework offers a combination of tariff caps, selective exemptions, and sector-specific commitments that should help prevent further near-term drama. With that said, key questions remain about how the EU-US relationship will play out in the long term.

Tariffs and exemptions

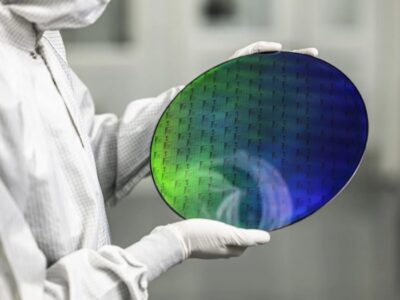

The deal establishes a 15% US tariff ceiling on most EU exports, including automobiles, semiconductors, consumer goods, and pharmaceuticals, averting previously threatened rates as high as 30% or more. This move is widely viewed as a de-escalation gesture following months of debate and tension.

I find zero-tariff treatment for semiconductor manufacturing equipment to be particularly important. The push by the US and EU to drive homegrown chip production—in competition with China, of course—is reinforced by their mutual commitment to open trade in advanced tech. It’s a clear sign of much-needed cooperation. However, since actual semiconductors remain under the 15% tariff, I assume Europe will still face challenges when exporting chips to the US.

Strategic purchases

The EU also agreed to purchase up to $750 billion in US energy exports over the next three years and invest approximately $600 billion in the US economy by 2028, the White House announced. Such commitments aim to promote market access, but critics argue they resemble aspects of a managed trade strategy rather than a liberal trade agreement.

Despite continued negotiations to potentially replace tariffs with quotas, the 50% duties on steel and aluminum remain. This highlights that parts of the market continue be excluded from the agreement as it stands.

Unanswered questions

While the announcement by EU Commission President Ursula von der Leyen and US President Donald Trump was welcomed by many, plenty remains unclear. How will disputes be processed and resolved? How will the EU and US manage compliance? While there be regular reviews?

In addition, reports since July 27 indicate that not everyone is on the same page. For instance, Euronews reports that French President Emmanuel Macron urged the EU Commission to restore balance in the EU’s trade relationship with the US shortly after a deal was announced.

Positive, but too soon to tell

Sure, agreement reflects a welcome return to negotiation. But it is too soon to tell how things will shake out. With key sectors like steel unresolved, we must remain cautiously optimistic.

For our eeNews readers, I think the deal represents both opportunity and uncertainty. Clearly, the tariff relief on semiconductor equipment signals support for innovation and potential supply chain resilience. But we must continue to wonder about the fragility of such agreements. As the industry navigates these shifting trade dynamics, staying informed and engaged will be critical to shaping competitive market moving forward.

Watch our recent long-form discussion (Elektor Engineering Insights #53) on supply chain issues, tariffs, and more.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News