Has the semiconductor industry turned the corner? – updated

Cette publication existe aussi en Français

Cette publication existe aussi en Français

A slew of poor financial results this week is nevertheless casting a ray of sunshine on the semiconductor market.

NXP Semiconductors saw a flat quarter that was down 5% on 2023, but is calling the bottom of the semiconductor cycle. So are TI and Silicon Labs.

“NXP delivered quarterly revenue of $3.13bn, consistent with our guidance, with all our focus end-markets performing in-line with our expectations. With our second quarter results and guidance for the third quarter NXP has successfully navigated the cyclical trough in our businesses and we expect to resume sequential growth. We continue to manage what is in our control enabling NXP to drive resilient profitability and earnings in a challenging demand environment,” said Kurt Sievers, NXP President and Chief Executive Officer.

Similarly Texas Instruments saw Q2 revenue of $3.82bn, down 16% year on year.

“Revenue decreased 16% from the same quarter a year ago and increased 4% sequentially. Industrial and automotive continued to decline sequentially, while all other end markets grew,” said Haviv Ilan, TI’s president and CEO.

The company is building several 300mm fabs in the US to be ready for the upturn and bringing more semiconductor test and assembly in-house.

“Over the past 12 months we invested $3.7 billion in R&D and SG&A, invested $5.0 billion in capital expenditures and returned $4.9 billion to owners,” said Ilan. “TI’s third quarter outlook is for revenue in the range of $3.94bn to $4.26bn.” This would still be down on the $4.53bn in Q3 2023.

STMicroelectronics also saw a drop of 6.7% in Q2 to $3,232m from the previous quarter and down 25.3% on the $3,465 of Q2 last year. But the company was upbeat.

“Q2 net revenues were above the midpoint of our business outlook range driven by higher revenues in Personal Electronics, partially offset by lower than expected revenues in Automotive,” said Jean-Marc Chery, President & CEO of ST.

“First half net revenues decreased 21.9% year-over-year, mainly driven by a decrease in Microcontrollers and Power and Discrete segments. During the quarter, contrary to our prior expectations, customer orders for Industrial did not improve and Automotive demand declined,” he said. “Our third quarter business outlook, at the mid-point, is for net revenues of $3.25 billion, decreasing year-over-year by 26.7% and increasing sequentially by 0.6%. We will now drive the Company based on a plan for FY24 revenues in the range of $13.2 billion to $13.7 billion.”

However Silicon Labs in the US today reported Q2 revenues of $145m, down 40% from $244m a year ago. Industrial & Commercial revenue for the quarter was $88m while Home & Life revenue was $57m.

But the company was upbeat about turning the corner as well.

“Silicon Labs delivered another quarter of strong sequential growth, driven by a combination of design wins ramping to production in several key growth areas, and end customers working down their excess inventory,” said Matt Johnson, President and Chief Executive Officer at Silicon Labs. “Looking forward, we expect revenue growth to continue in the third quarter as excess inventory is further reduced, design wins continue ramping, and bookings improve.”

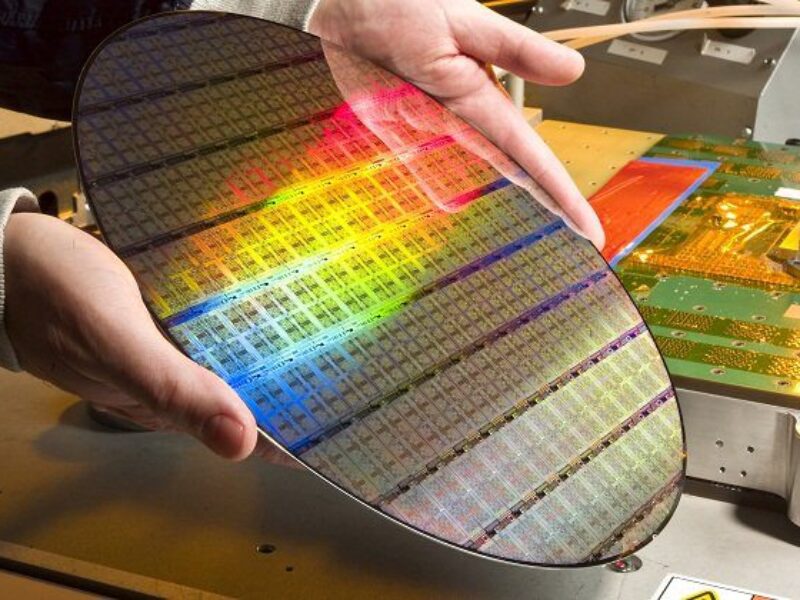

Last week TSMC announced second quarter revenue of $20.82bn, up 32.8% year-over-year and up 10.3% on the previous quarter. Advanced technologies accounted for 67% of total wafer revenue with shipments of 3nm wafers accounting for 15% of total wafer revenue; 5nm accounted for 35%; and 7nm accounted for 17%.

“Our business in the second quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand.”

Even Intel is expected to see a slight increase to $13.02bn for the quarter, following $12.72bn in the preceeding quarter, lower than analyst expectation. Overall analysts are expecting 4% growth for Intel this year, with 12% next year, largely as a result of the boom in data centre AI semiconductors. It has also launched its first EV automotive chip.

www.nxp.com; www.ti.com; www.siliconlabs.con; www.tsmc.com; www.intel.com

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News