Trends in the smart card payment industry — chip innovations drive new applications and services

Regional markets differ in their requirements with respect to applications and technologies, so high-performance, innovative chip solutions are key drivers for the continuously growing and very dynamic payment market. And, independent of the form used for payment, be it a smart card or a mobile phone, the protection of the customer’s credentials against manipulation and fraud is key to any successful implementation.

The payment chip-card market shows a clear trend towards contactless and converging applications. Contactless payment can be performed with smart cards as well as with mobile devices. In particular, the demand for Dual Interface (DIF) payment cards is growing. These cards are equipped with a contact-based interface to support traditional payment transactions, but at the same time they offer a contactless interface to perform access, transport or micropayment roles.

This convergence of services will result in an increasing demand for multi-application cards. These could, for instance, be credit/debit cards that support additional applications, thus giving the issuer of the card – the bank or credit-card institute – an edge in a highly competitive market.

While DIF cards will clearly dominate the market in the near future, the parallel demand for hardware-based security solutions for mobile payment is steadily growing. Though offering similar combinations of applications to smart cards, mobile payment is experienced differently by users. Implementations include remote payment, like ordering goods or services in the Internet, as on a desktop computer; proximity payment with an NFC-enabled device, equivalent to a contactless card transaction; or using a mobile device as card reader. Even though these payment services are offered by market players such as mobile network operators, smart-phone manufacturers or service providers, they also require hardware-based security chips in various forms to protect customer credentials. Typical forms of secure elements might be SIM, µ-SD cards or embedded Secure Elements integrated into smart phones or tablets.

Figure 2: Mobile payment solutions require security chips (e.g. Secure Elements) in different forms.

High market potential for smart cards

Consequently, the industry is facing a high market demand for chip-card-based payment applications. Worldwide, payment cards are being migrated to more secure chip-based solutions, with a strong growth in DIF products. The major driver is the liability shift for banks according to the regulations of EMV (Europay MasterCard VISA). Today, only some 40% of the payment cards in circulation are chip-based. The secure-microcontroller payment market is expected to grow at a CAGR of +19.5% from 2013 to 2017 in terms of volume (IHS 2013). In 2017 DIF solutions will dominate the market.

Two major trends figure prominently in national banking schemes. In their quest to combat fraud and to improve system security, more banks worldwide are turning towards DDA (Dynamic Data Authentication) technology based on asymmetric encryption.

As a second trend, many banks are gearing up to issue contactless and dual-interface payment cards to provide greater convenience and added-value features for their customers, where multiple applications and mobile payment are the key drivers.

Security and convenience

The payment market is diversified, with a wide range of local systems and infrastructures, but there are some common criteria to ensure adequate security and convenience for the end customer:

- Security certifications, such as EMVCo approval;

- Superior performance for fast transactions and support of multiple applications;

- Low power consumption for contactless application;

- Support of global infrastructure implementations.

Infineon helps the value chain to develop better, more secure products without compromising the cost factor. Infineon supports payment providers on a worldwide basis, and is active in all relevant standardization bodies and security authorities.

Infineon’s payment portfolio ranges from chip card ICs for low-end EMV SDA to high-end-security devices targeting EMV DDA, CDA or open-platform applications. The payment portfolio will continuously be enhanced and diversified across all regions, independent of the form used.

But not only chip performance and security are essential for chip card products; time-to-market is also becoming more important.

Faster time-to-market with SOLID FLASH products

Infineon equips all new security controllers with its SOLID FLASH technology. There are numerous advantages from using this flexible, secure, robust memory, so ROM (Read-only Memory)-based products for payment will be successively phased out, as SIM card controllers or automotive products were years ago.

Whereas ROM products require several efforts with to apply a new code, this can be done immediately with SOLID FLASH products. This reduces the development and delivery times by months, and speeds up the time-to-market compared to traditional, inflexible ROM devices without compromising on security or reliability. All SOLID FLASH products are certified according to EMVCo and other type approvals, as well as the Common Criteria up to EAL6+(high)

In addition, Flash products allow product customization to be carried out at a later stage in the value chain, so that card manufacturers can decide just before shipment of the card which operating system and application code are to be programmed into the Flash devices, depending on the project and market requirements. This offers significantly higher flexibility compared to ROM mask products, where each project typically requires a specific mask and the total production process down to the semiconductor factory has to be carefully planned.

Figure 3: SOLID FLASH concept enables faster time-to-market with flexible, secure, fast mask technology. Click image to enlarge.

Contactless performance and fast transaction times

To support the trend towards contactless transactions, the latest SOLID FLASH security controllers from Infineon have outstanding contactless functionality designed into them. Equipped with true 16-bit architecture, they show a performance increase of up to 40 percent in typical contactless applications, compared to 8-bit controllers. Produced in 90nm technology, the SLE 77 and SLE 78 families comprise more efficient instructions and larger register sizes, and provide fast transaction times, e.g. for multi-application cards including transport functionality. This significantly increases the convenience for the end user and the acceptance of the contactless use of payment cards.

Product families

Within one family, the SLE 77 covers SDA and DDA payment applications for both contact-based and contactless/dual-interface projects, as well as transport-market and selected ID applications. It is equipped with the features and cryptographic coprocessors needed for symmetrical and asymmetrical encryption, has up to 240KB of NVM, and is certified according to EMVCo and EAL5+ (high).

Figure 4: High-performance 16-bit controllers like the SLE7x family provide fast transaction times and multi-application support with increased user convenience. Click image to enlarge.

The SLE 78 family brings a lot of advantages to the market for projects, where longevity is most in demand. Selected payment projects and the majority of Government ID customers rely on this family, which incorporates unique functions and mechanisms based on the award-winning Integrity Guard technology. Thanks to Integrity Guard, the security controllers are able to monitor the entire data path continuously by means of comprehensive error detection. This is suitable for high-end applications in which the stored data require an especially high level of protection such as e-signature applications, in which electronic certificates are to be securely stored on chip. The SLE 78 security controllers have two CPUs, making error detection possible even during data processing. The SLE 78 family is certified according to EMVCo and CC EAL6+ (high).

Intelligent packaging to ease DIF card production

‘Coil on Module’ (CoM) is an innovative chip package technology for DIF debit or credit cards. It is based on an inductive coupling technology, as opposed to the usual mechanical-electrical connection between the card antenna and the chip. The major advantage of CoM is that the DIF chip cards can be produced on existing contact-based equipment, which helps especially smaller customers around the world to start ramping up to DIF cards without major investments.

Moreover, CoM improves the robustness of the payment card in the field, and simplifies the design options for the card and the inlays, while card manufacturing becomes more efficient and faster than with conventional technologies. It also reduces the thickness of the card for cosmetic reasons. Consequently, it saves costs throughout the entire process. This package innovation will make it easier to supply DIF cards, thus further accelerating the introduction of payment solutions supporting contactless functionality while saving costs along the value chain.

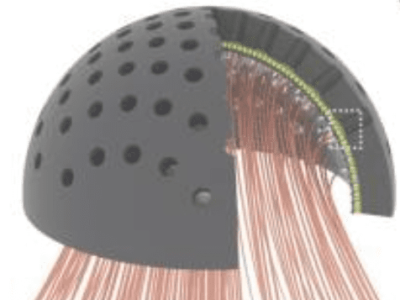

Figure 5: Coil-on-Module design employing inductive coupling allows cost-effective manufacturing of robust DIF cards.

Open standards

Open standards are a prerequisite for mass deployment and the introduction of multi-application cards. CIPURSE is a truly open security standard intended to overcome existing monopolistic solutions for transport authorities, banks and governmental solutions. It is optimized for secure contactless applications, and will drive the growth of multi-application technology.

It is expected that ticketing programs for public transport – that is, combined with payment functions – will act as a major growth driver for contactless multi-application cards, because the infrastructure (readers, gates) is already installed, and users benefit from the increased convenience compared to contact-based transactions. But there is both a technological challenge with respect to performance, speed and security of existing systems and a financial challenge for transport authorities, once investment in a new infrastructure becomes necessary. There is a clear advantage in standardized and open transport schemes, because only they allow sustainable investment for transport agencies.

CIPURSE has been developed by an industry consortium, and offers state-of-the-art security features (AES128 encryption) and fully flexible implementation from low-end to high-end solutions. It is not surprising that is has been adopted by many companies and, in a very short time frame, has evolved from a pure transport scheme towards a multi-application (transport, ID, micropayment, access, loyalty) implementation. The chance to develop interoperable, certified products that work across different systems and even cross borders makes open standards very attractive for the industry. Another advantage is that there are multiple vendors, which means a choice for the end customer and allows non-discriminatory public tenders.

SOLID FLASH products suit CIPURSE perfectly, as they offer the flexibility needed for the multiple implementations.

Conclusion

The smart card payment industry shows a clear trend towards Dual Interface/contactless solutions and multi-application implementation in Smart Cards and beyond, such as in a mobile payment environment. The rapid increase of chip-based payment cards in more and more diversified applications and offerings does require security solutions that allow products to be custom-made without compromising time to market or security. Digitalization and increased connectivity will strongly influence the development of the cashless payment market; new market players, various mobile devices and established smart-card solutions will drive convenient contactless applications. Innovations in hardware therefore help the value chain while implementing new services. High-performance security chips with fast transaction times, flexible packaging technologies, support for different forms and open standards are the prerequisites for response to market demand and mass deployment of new solutions.

The author

Björn Scharfen is Marketing Director, Head of Product Marketing & Management

Business Line Secure Mobile & Transaction, at Infineon Technologies — www.infineon.com.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News