Europe looks to the end of the mobile phone

The recent $500m deal for Snap to buy a key supplier for its AR glasses, Oxford-based WaveOptics, has much wider implications. Suppliers are seeing the mobile phone market plateau, and augmented reality systems are the next display technology. Like mobile phones, European companies are playing a key role in the developing technology.

“I like to believe we are at the same level of change as in 2005 with MEMS accelerometers, now we see an inflection point where mobile phones are declining and we believe that AR can be the next big thing,” said Marco Angelici, who is charge of the MEMS actuator business unit at STMicroelectronics, both from the MEMS side and driver side includes the LASAR and the Qanta alliance.

“We want to target the end of mobile phones,” he said.

ST is focussing on laser beam scanning using mircomachined (MEMS) mirrors, which is in the market with several different technologies. For example, Microsoft’s Hololens is using laser scanning, and so is North which was acquired by Google. ST also has an automotive joint design win for 2024/25 with Leddartech for automotive lidar using the technology.

ST has a range of MEMS technologies, from capacitive and electrostatic to piezoelectric, giving the company a range of different approaches. For the first laser AR systems. the company started out with electrostatic control of the beams from red, green and blue laser diodes, and these devices are sampling now, but points to piezoelectric controllers for the MEMS mirrors, built at ST’s 8in fabs in Milan and Singapore.

“For AR piezo we believe is the right technology,” he said. “Piezo material is a big area of research, to improve the force and efficiency and this gives us a scalability roadmap to improve the power consumption. It’s a capacitive load and we include energy recovery to reduce the power consumption.

The company had already started working on the piezo technology and acquired bTendo in 2012 for its Scanning Laser Projection engine. A key capability is the energy recovery as the piezo material relaxes, which can reduce the overall power, critical for wearable designs.

“At the beginning of 2020 we decided to have a parallel path [for a standard product] alongside key selected customers with customised solutions to start addressing the problem of an optical engine for the AR market. We are not targeting the fully immersive XR market but the AR smart glasses for all day wearing and we started working with partners to match all the ingredients.”

This led to the LASAR Alliance, bringing together various companies for a complete AR system. This combines the laser diodes and MEMS mirror for the optical engine and the optical waveguide to provide the display it the glasses. The same technologies can be used in high volume automotive designs.

“With the LASAR alliance we intended to work with key companies in the supply chain to stimulate the full system. The Alliance is now incorporated into the IEEE standards so we can open up to the big list of companies that want to join,” he said.

“Piezo is at the core of the mirrors and we are working together with the A*Star laboratory in Singapore and ULVAC to build an R&D centre for piezoelectric materials in our ST fab. This uses the same equipment as the production line to deliver a prototype that is ready to move into production.”

“Then we need someone to manufacture the complete systems in volume for customers and that’s Quanta which is very important.”

The aim is AR glasses that are wearable all day and weigh less than 60g with a 500mW power consumption. “We can achieve that this year with 1000nits of brightness for outdoor applications, compared to 500nits displays that need darkened lenses, and a 30 to 50 degree field of view (FoV) is enough,” he said.

“In the end there is a tradeoff in power consumption. The way you build the waveguide is where you lose the field of view. Increasing the field of view means the energy is relayed into the combination of the lenses so the limitation is on the capabilty of the waveguide to have a good colour uniformity across the field of view, and we are working with waveguide makers to get to 60 to 70deg. Today Hololens has 55 degree field of view for example but the military were asking for more than 85 degrees.”

The laser diodes with a piezo MEMS mirror has power advantages across the whole system, he says.

“We are able to illuminate on a per pixel basis so what we found from the Lasar Alliance was we don’t need a full frame buffer in the video processor so can use one or two lines, and we don’t need a backlight or illuminated substrate.

“The way we do the laser driver is customised, we integrate look ahead logic to switch pixels off when there are consecutive black pixels. With a key customer we find what comes out of the application processor so we can switch off more pixels so we focus on the fast rise and fall time,” he said.

“On the MEMS side we have developed the energy recovery where we reuse the energy from the previous cycle – we have built a driver with integrated capacitor in the piezo in the chip and we have patents on the synchronisation of this to generate the next voltage.”

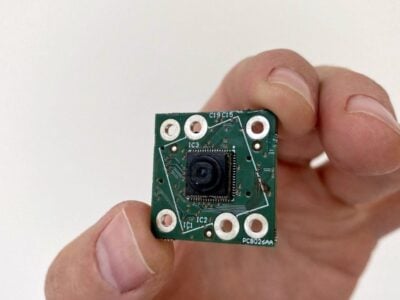

- Reference design for volume AR smart glasses

- New designs for more wearable AR glasses

- LaSAR Alliance targets smart glasses

“We partner with Osram in Germany for the laser diodes and the beam forming from the optical engine has to be shaped for the coupling with the wave guide. This is a critical element and we worked with key partners and have come out with an efficient design for that and we know what we need to do for the next generation.

The waveguide is essentially the physical lens of the glasses. In the North design there was a holographic reflective film on the lens of the glasses to project an image into the retina, but this needed a precise fitting. In contrast, diffractive etching on the glass of the lens takes the beams from the optical engine and reflects it into the side of the lens of the glasses using total internal reflection with a much larger ‘eye box’, or viewing area, of 10mm compared to 1mm.

An electrostatic optical engine is in mass production used by North in first generation glasses 960 x 600p and this is sampling to key customers. The next generation will be 40degree field of view, targeting 50 degrees in the future, he says.

The design being developed within the LASAR Alliance is different, with a diffractive waveguide. “We selected a diffractive waveguide to give a 10mm eye box which retina display or holographics waveguides can’t do,” he said. “The eye box is important to have one size fits all.”

This is supplied by Dispelix in Finland, and will be combined with the next generation optical engine from ST for prototype glasses that weigh 58g.

“We are building a new generation called Star1 available in a few months from now with 65deg FoV and 1280 x 720p resolution and 0.7cc using the frame buffering and energy recovery which will reduce the power consumption 50 percent from the first generation.”

Star0 has a power consumption of 1220mW for a ful white display to 742mW for 10 percent white, depending on the complexity of the video, while Star1 is at 781mW for full white down to 312mW for 10 percent.

“By 2023/24 we will have 50 percent improvement in the actuation and that will reduce the die size by 30 percent and the power reduction of 50 percent, or 90 give a FoV or 1080p resolution,” said Angelici.

Related AR articles

- Next generation augmented reality smart glasses

- Smart glasses boost from tiny full colour laser module

- Smart glasses to merge with AI, computer vision to ID images

Popular articles on eeNews Europe

- Covid-19 costs hit Electrocomponents

- 22 new 200mm fabs in capacity boom

- Boom quarter for top 10 semiconductor companies

- Raspberry Pi shortage driven by demand

- Newport Wafer Fab faces Chinese takeover

- Swiss centre aims for 100 qubit quantum computer

- ST looks to combine GaN power with microcontrollers

- MIT charts path to 1nm chips

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News