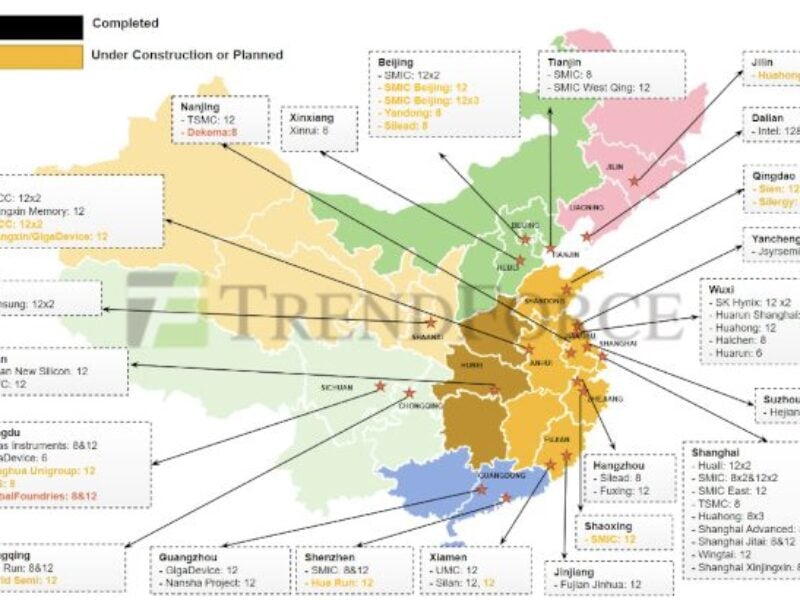

An audit by TrendForce has revealed 44 wafer fabs operating in China with 22 fabs under construction with most of these away from the leading edge.

A cadre of recently IPO-ed foundries has joined China’s number one foundry SMIC and are leading a charge into yet more manufacturing, despite supply exceeding demand, the market researcher said. The 44 operating fabs includes those of Samsung, SK Hynix, Texas Instruments, TSMC and UMC.

In the future, SMIC, startup foundry Nexchip, DRAM firm CXMT, and microLED startup Silan have plans to construct an additional ten fabs Therefore by the end of 2024, China is aiming to establish 32 large fabs, and all of them are about to focus on relatively mature processes.

HuaHong Group went public on the STAR market of the Shanghai Stock Exchange in August. Nexchip listed in May. Additionally, SMEC, closely linked to SMIC, also went public on the STAR Market without turning a profit.

A global slowdown in demand is noticeable in automotive and industrial applications. With inventory building 2024 is expected to pose challenges for the recovery of capacity utilization (see Global fab utilization to drop below 70 percent in 4Q23, says SEMI).

Chinese wafer fabs completed, under construction or planned. Source: TrendForce.

While China is not immune to this, TrendForce reckons import substitution policies have provided some mitigation.

According to TrendForce, the global ratio of mature (>28nm) to advanced (<16nm) processes is projected to hover around 7:3 from 2023 to 2027. Propelled by policies and incentives promoting local production and domestic IC development, China’s mature process capacity is anticipated to grow from 29 percent in 2023 to 33 percent in 2027.

The 44 fabs currently operated by Chinese companies exclude seven sites where construction is temporarily suspended. The 44 comprise 25 fabs at 300mm, 4 fabs in 6-inch wafers, and 15 fabs for 200mm wafers. The 22 under construction are 14 for 300mm wafers and 8 for 200mm wafers. The 10 wafer fabs in planning are all for 300mm wafers except one.

The audit shows that China currently operates 31 fabs at 300mm, including those under construction with capacity for 12-inch. The total monthly manufacturing capacity is currently1.189 million wafer capacity but with capacity utilization at those fabs down around 55 percent.

TrendForce anticipates that China will add 24 fabs at 300mm in the next five years, with a planned monthly capacity of 2.223 million wafer capacity. Assuming all planned 12-inch wafer foundries achieve full production, by the end of 2026, the total monthly capacity of 12-inch in China will exceed 4.14 million wafer capacity.

Related links and articles:

News articles:

Hua Hong plans to raise US$3 billion via Shanghai listing

China’s Big Fund invests yet more billions in memory firms

Chinese startup MEMS, power foundry set to IPO

SMIC spin-off foundry ramps MEMS, power chip production

Global fab utilization to drop below 70 percent in 4Q23, says SEMI

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News