Foundries see cancellations as consumer spending slows

Foundries have seen a wave of order cancellations, mainly behind the leading edge of production, and the chip manufacturing capacity utilization rate has started fall, according to market research firm TrendForce.

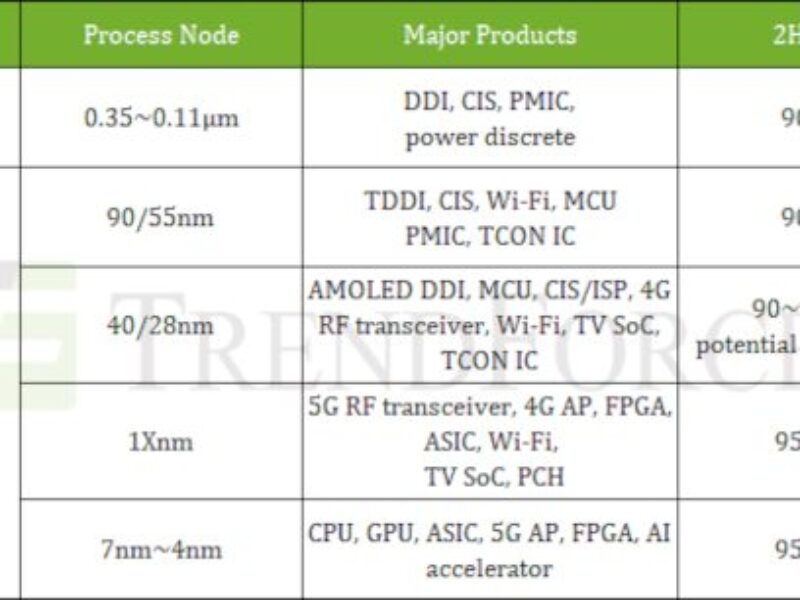

The first order revisions were in large-screen driver ICs and touch and display driver integration (TDDI) chips. A wave of cancellations has also emerged for power management ICs, CMOS image sensors, and certain microcontrollers and SoCs.

TrendForce sees the inventory adjustment for smartphones, PCs, and TV-related peripheral components continuing in the second half of 2022 with companies beginning to reduce their wafer orders with foundries.

- Semiconductor market heads for severe downturn says analyst

- Chip market falls in 1Q22

- ST, GlobalFoundries to build 300mm FD-SOI fab at Crolles

Equipment order cancellations have also grown as consumers begin to curtail consumer electronics spending in the face of global monetary inflation. This is now playing through to a semiconductor supply chain that was undersupplied and manufacturing at full capacity.

The manufacturing capacity utilization of processes on 200mm-diameter wafers are set to decline the most.

The nodes impacted include are mainly trailing edge above 100nm but also 90/55nm and 40/28nm. But 7/6nm manufacturing processes are not immune TrendForce said. However, 5/4nm processes will remain near full load, driven by planned product introductions.

TrendForce said the overall capacity utilization rate of 200mm wafer fabs will be between 90 and 95 percent in 2H22 and dipping below 90 percent for some processes and product lines. The capacity utilization at 300mm wafer fabs will remain higher partly due to the production mix and partly due to the fact that with more complex processes wafers spend longer in the fab making transitions slower.

In 2H22 the 300mm wafer fab capacity utilization, which had been above 100 percent, will settle to a typical figure of 95 percent, indicating supply, demand balance. However, some manufacturers that mainly produce consumer products may see capacity utilization rate fall below 90 percent.

News articles:

- TrendForce revises view of Covid-19’s impact on end-markets

- Going down: Annual chip market growth continued to soften in May

- Chip market recession coming: ‘on-shoring’ production is major threat

- Global chip market to be worth $600 billion in 2022

Other articles on eeNews Europe

- Ericsson, Thales team for 5G satellites

- Nordic Semiconductor buys its memory supplier

- Europe steps up as RISC-V ships 10bn cores

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News