Electronics eats the car industry

The Covid-19 pandemic has highlighted the essential role that semiconductors play in the car industry, from sensors to AI. Switching off the supply of chips was easy, but the pandemic showed that the chip business cannot work to ‘just in time principles’ and switching back on supply takes time.

Car makers around the world, from Ford and General Motors to Volkswagen, have all had to scale back production as a result of the chip shortages. This has led to heated calls from politicians to foundries in Taiwan, and calls for dramatic increases in funding for European chip makers.

This comes on top of increasing electrification of cars and a move to more autonomy, both of which increase the semiconductor content in a vehicle. Some automotive chip makers such as STMicroelectronics and Texas Instruments managed to avoid the downturn caused by the pandemic, while others such as NXP, On Semiconductor and Bosch have struggled.

This trend was apparent ahead of the pandemic. The world’s largest electronic equipment maker, Foxconn, has turned its sights on the car industry. It has spent the last three years developing a horizontal platform that global brands can use to deliver their own cars. These brands are taking on the struggling vertical model of car makers that is highlighted by the consolidation of Fiat Chrysler and Citroen Peugeot into Stellantis last month.

Foxconn already has a strong track record as a supplier to BMW and to Apple, says Malcom Penn of market analyst Future Horizons looking at the key trends for the industry.

“Electric Vehicles are really upending the automotive market and who is creeping into the EV spectrum? Apple and Foxconn. Once it’s in a horizontal manufacturing model that will change the automotive world,” he said. “Cars are already a platform design and the EV will be the final horizontal platform transition,” he said.

“Its already happening with Tesla. They are designing their own ICs with 260mm2 AI chips. These are not small chips, and are designed in house by Tesla engineers. You don’t see the car makers building their own large chips, and these are the real brains behind the new EV cars,” he points out.

The shift is happening how, he says. “Foxconn wants to be the Android of the EV market with 10% of the market by 2025 and they already supply Tesla and BMW,” he said.

“Go back and see what happened to Nokia in mobile phones and DEC in computing, the shift can happen quickly” he said. “It’s easier for Apple and Google to get into the car industry than the car industry to get into chips. No industry is safe from semiconductors. They haven’t seen it coming and just like Nokia refused to believe it, their classic business model is over,” he said.

Years of driving down costs have left the car makers at a disadvantage.

“Why should the chip industry favour automotive makers – they have the worst terms in the market and don’t want to pay for reliability, so tough,” said Penn. “All of the big system and service companies are designing their own chips and servers, it’s the natural thing to do. You can hire the best engineers and make the best products. Covid-19 was the high tech tipping point,” he said.

This is also reflected in the current frenzy around Apple’s plans for a car. Hyundai and Kia see the potential for a deal to leapfrog its smart electric vehicles into the big league. Nissan also said it had been approached but discussions did not get to a senior level. The company strogly resisting becoming a ‘contract manufacturer’ for Apple.

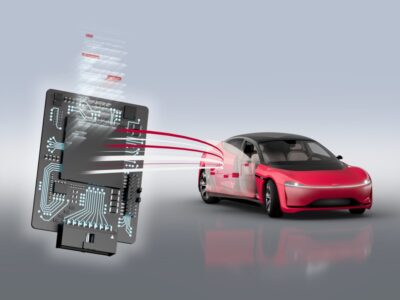

This follows Sony showing off the technology in its own car, the Vision-S, taking advantage of key European technology suppliers with sensors and AI. NXP’s recent launch of the third generation of its BlueBox development platform with Kalray’s MPPA AI processor also highlights the shift.

“You need to have a fairly good behaviour model of the car and that’s the DNA of the car OEM,” said Arnaud Van Den Bossche, Director, Global Product Marketing for eCockpit and ADAS, NXP Automotive Processing. “That’s where we see the car OEMs focussing. This means the autonomous vehicle has to behave like a particular premium car – you need to modalise the dynamic of the car. All these algorithms are very complex and not yet really addressed. That how the OEMs will differentiate. Its really a software problem rather than hardware – that’s why its very important on the hardware to provide the right flexibility in how you programme the different algorithms so the BlueBox is not just hardware but allowing the customers to port their AI algorithms.”

But the evolution of the technology in the car industry is not over. “The next step after that is hydrogen and its good news for semiconductors as there more electronics required than in an EV,” said Penn. “It is gaining traction but the big issue is generating the hydrogen. There’s a lot of work going on the EU on that.”

www.eenewsautomotive.com; www.eenewspower.com

Other articles on eeNews Europe

- Top ten chip markets for 2021

- Infineon to build quantum processor

- Automotive puts ST back on the road to $12bn

- TI shrugs off Covid-19, chip shortages

- On Semi hit by Covid-19 downturn

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News